Students on an F1 Visa Don't Have to Pay FICA Taxes —

Por um escritor misterioso

Descrição

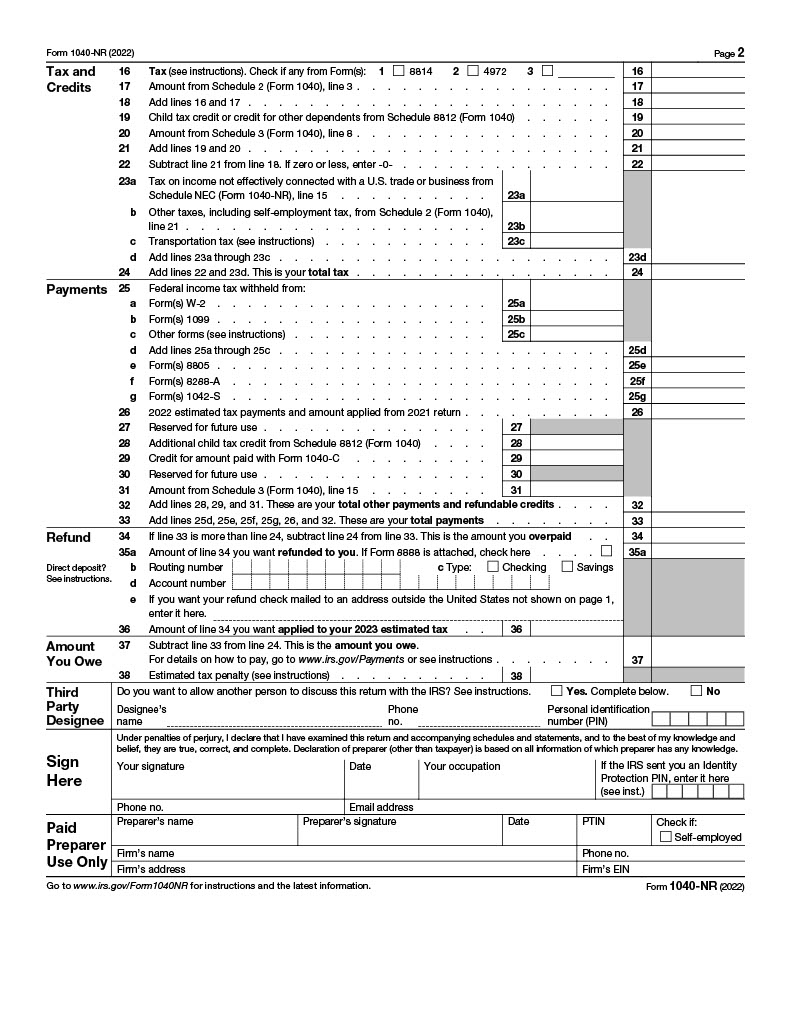

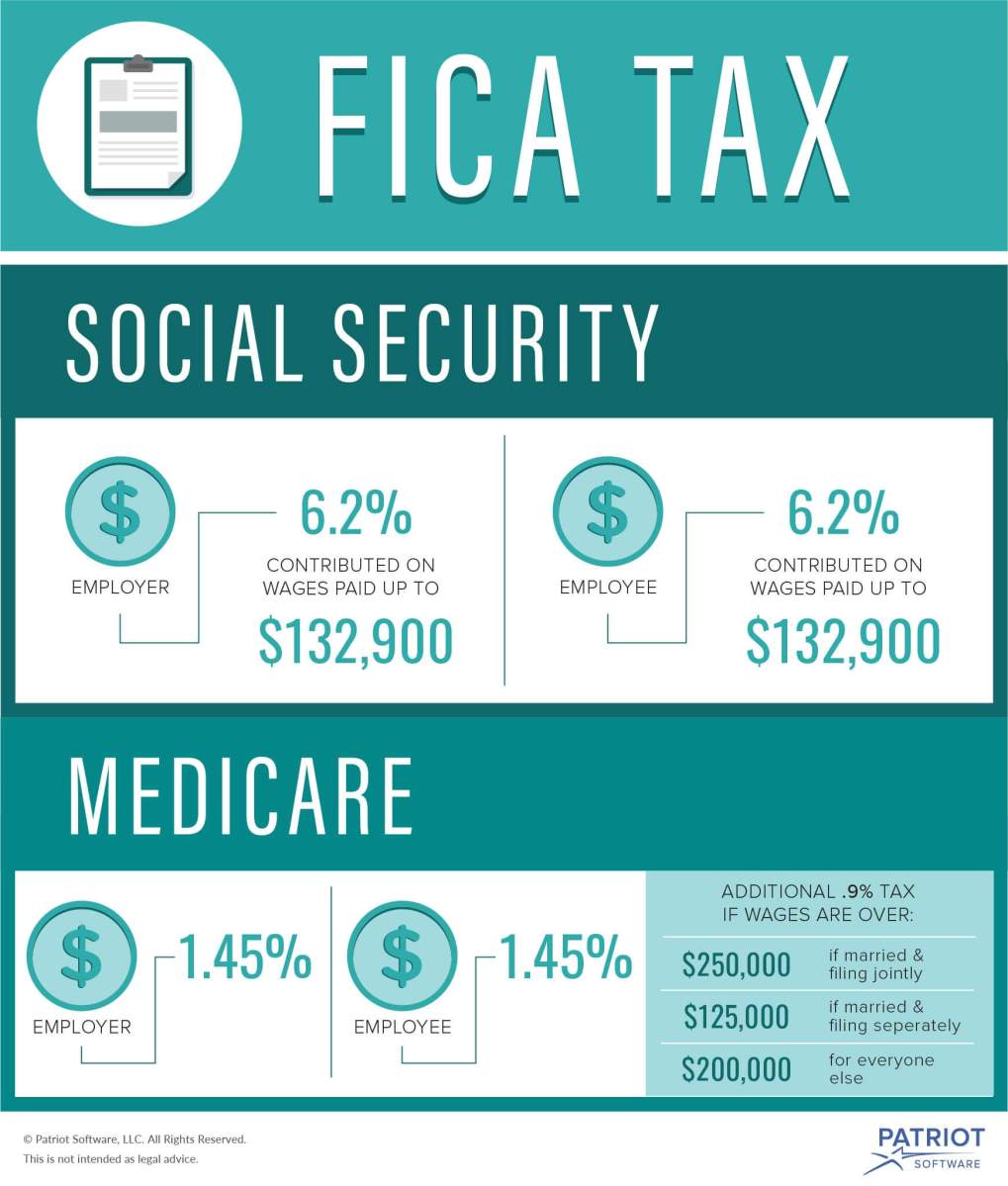

In general, non-US citizens employed in the U.S. are required to pay FICA taxes. However, those with single intent, or non-immigrant status (or F1 visa holders) are exempt from FICA taxes.

Pros and Cons : Working in OPT or H1B Visa

The Complete J1 Student Guide to Tax in the US

Filing Taxes as an International Student - eduPASS

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

Filing Taxes When You've Been Employed On Campus

Filing Your Non-Resident Tax Forms using Sprintax (F and J)

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

FICA/ Social Security Tax :: International Student and Scholar Services (ISSS)

What Students Need to Know About Filing Taxes This Year

How to Get FICA Tax Refund - F1 Visa, CPT and OPT Students

de

por adulto (o preço varia de acordo com o tamanho do grupo)