What Is Social Security Tax? Definition, Exemptions, and Example

Por um escritor misterioso

Descrição

The Social Security tax, levied on both employers and employees, funds Social Security and is collected in the form of a payroll tax or a self-employment tax.

The Evolution of Social Security's Taxable Maximum

Program Explainer: Windfall Elimination Provision

Types of Taxes – Income, Property, Goods, Services, Federal, State

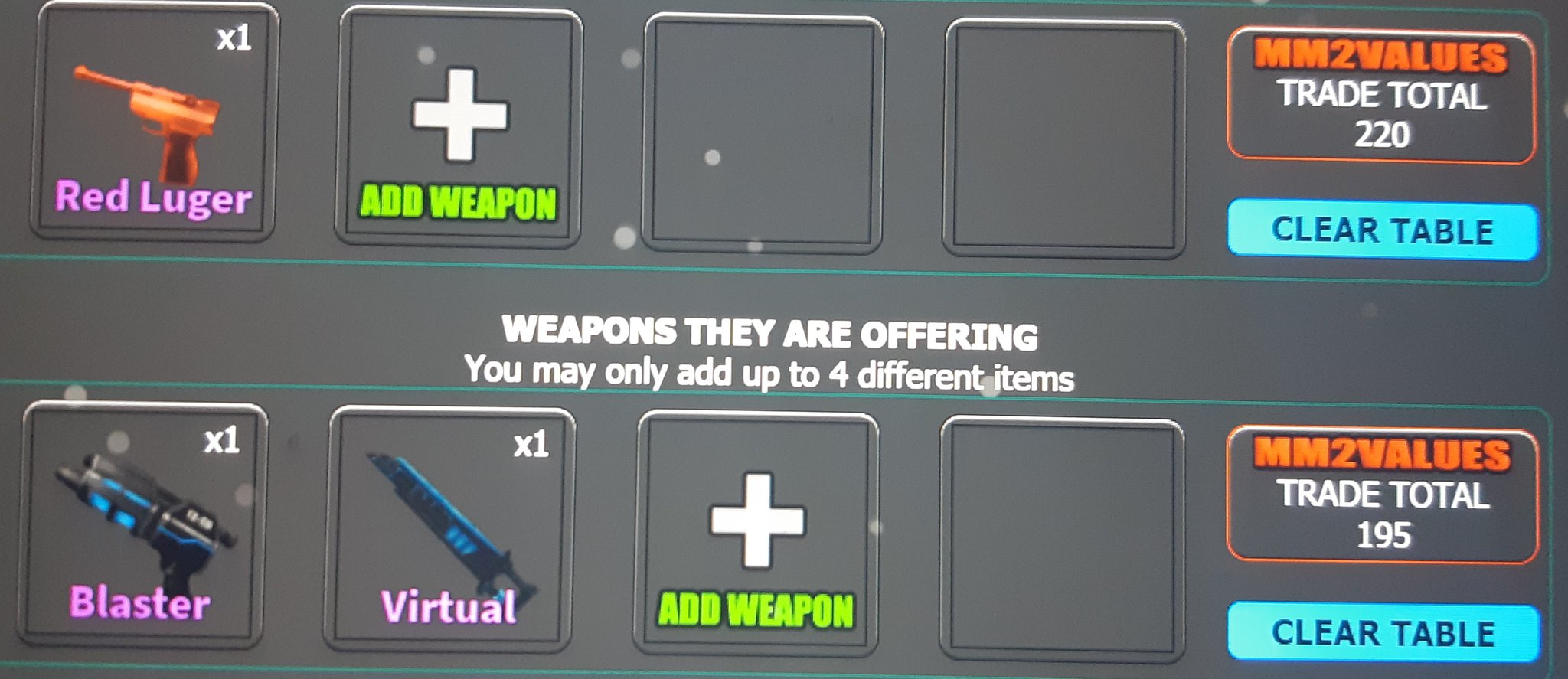

Social Security Taxes: 3 Ideas to Help Minimize the I - Ticker Tape

What is Social Security Tax?

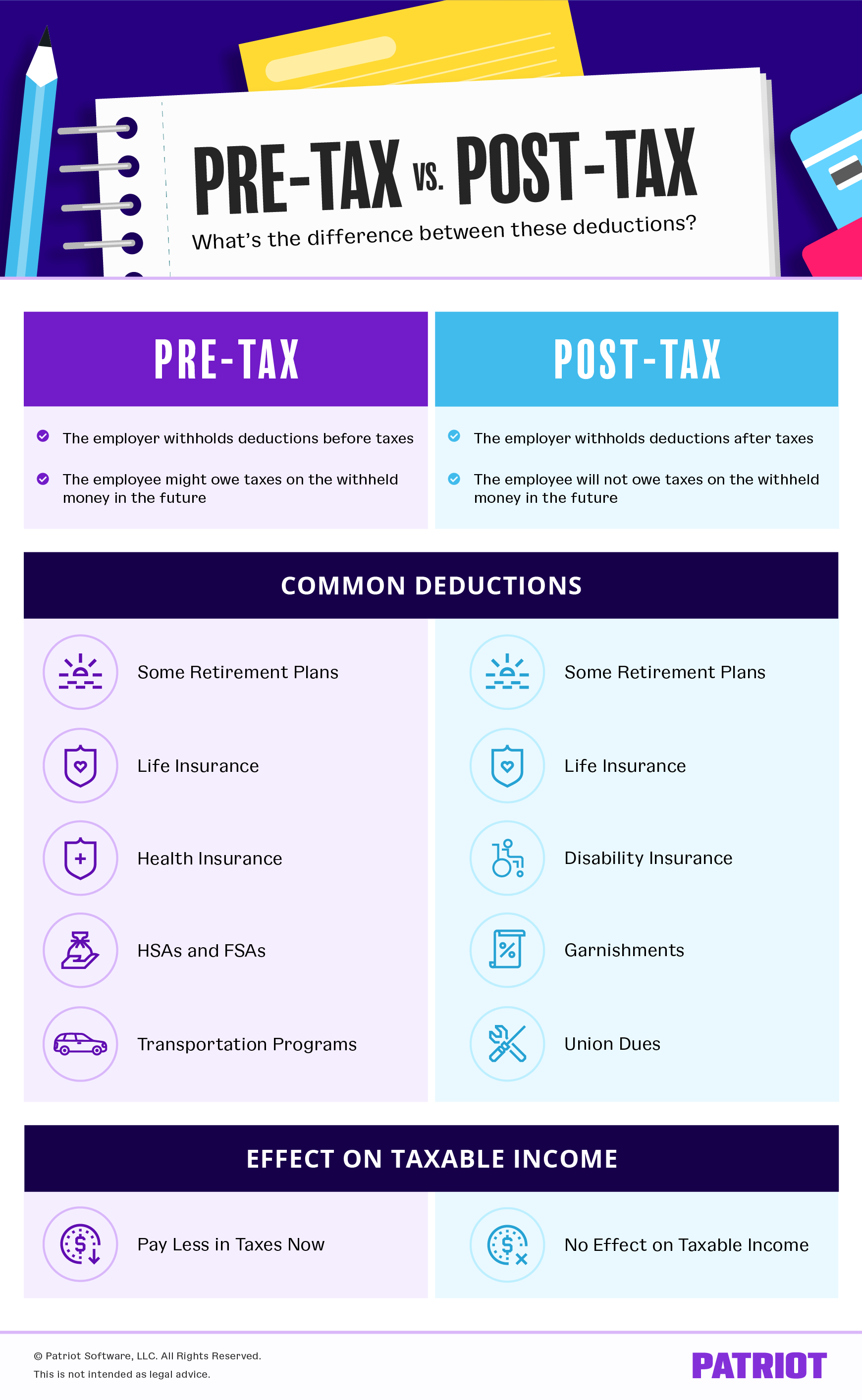

Pre-tax vs. Post-tax Deductions - What's the Difference?

Payroll tax - Wikipedia

Tax Exempt - Meaning, Examples, Organizations, How it Works

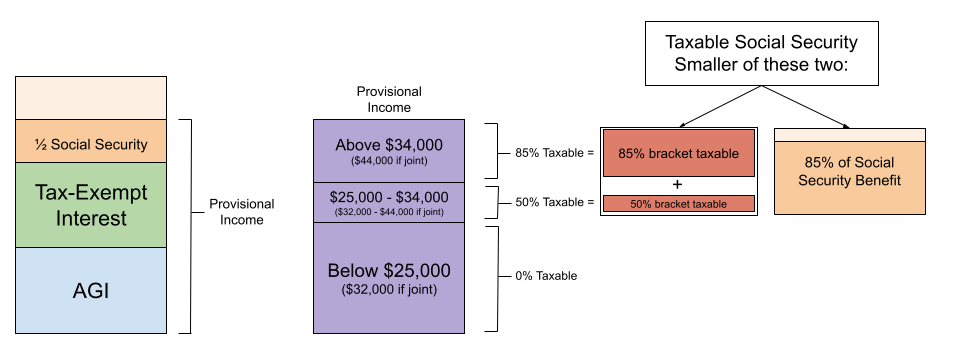

How to Calculate Taxable Social Security (Form 1040, Line 6b) – Marotta On Money

7 Things to Know About Social Security and Taxes

Federal Taxation of Social Security Benefits

de

por adulto (o preço varia de acordo com o tamanho do grupo)