Bona Fide Foreign Resident Definition

Por um escritor misterioso

Descrição

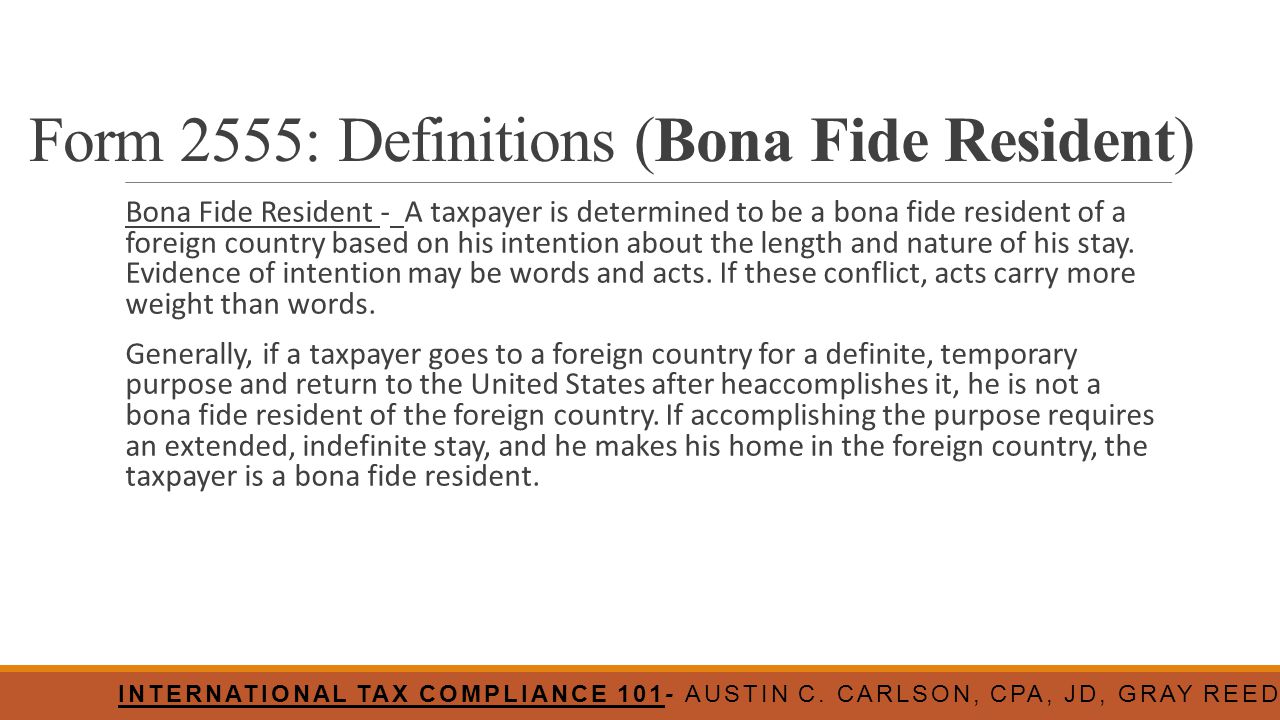

A Bona Fide Foreign Resident is a resident of a foreign country for an entire tax year, who the IRS deems eligible for the foreign earned income exclusion.

Reducing Foreign Income Taxes for US Citizens Living Abroad

PDF) Practicing Law Without an Office Address: How the Bona Fide

Publication 54 (2022), Tax Guide for U.S. Citizens and Resident

FEIE - Physical Presence and Bona Fide Residence - Shanghai Expat

Foreign Earned Income Exclusion - SmartAsset

Foreign Earned Income Exclusion for US Expats

IRS Form 8898 walkthrough (Beginning or ending bona fide residence

Filing Form 2555 for the Foreign Earned Income Exclusion

What is a Foreign Earned Income for U.S. expats? - 1040 Abroad

Remote Financial Planner

Adjustment of Status Explained. Documents Required

Foreign-Earned Income Exclusion for U.S. Citizens in China - China

International Tax Compliance ppt video online download

de

por adulto (o preço varia de acordo com o tamanho do grupo)